Have you had “The Talk”?

You’ve likely heard stories of family members who stop speaking to each other because of a disagreement over “what mama or daddy wanted me to have” after their parents died. Maybe you’ve even been a part of such a quarrel. These tales are all too familiar, even in once close-knit farm families.

Such events are sad to hear and even sadder to view firsthand. What’s worse is that in most cases the issues could have been avoided with better planning and more effective communication. Although it may be unpleasant to think about, death and taxes are still two things that are pretty much unavoidable.

There are some basic questions that will likely arise after we pass. These might include: Will the farm be split up among the heirs or kept in one piece? Will the farm have to be sold to pay the nursing home bill? Will there be a family feud over who gets what? Is there a plan in place for an orderly transition that allows the farm to continue operation as a farm?

Many people want to pretend that these questions will never arise in their own family or want to avoid having what can be a painful discussion with family members. Furthermore, most of us have no idea how valuable some of our assets are or how much will be lost if a plan is not in place.

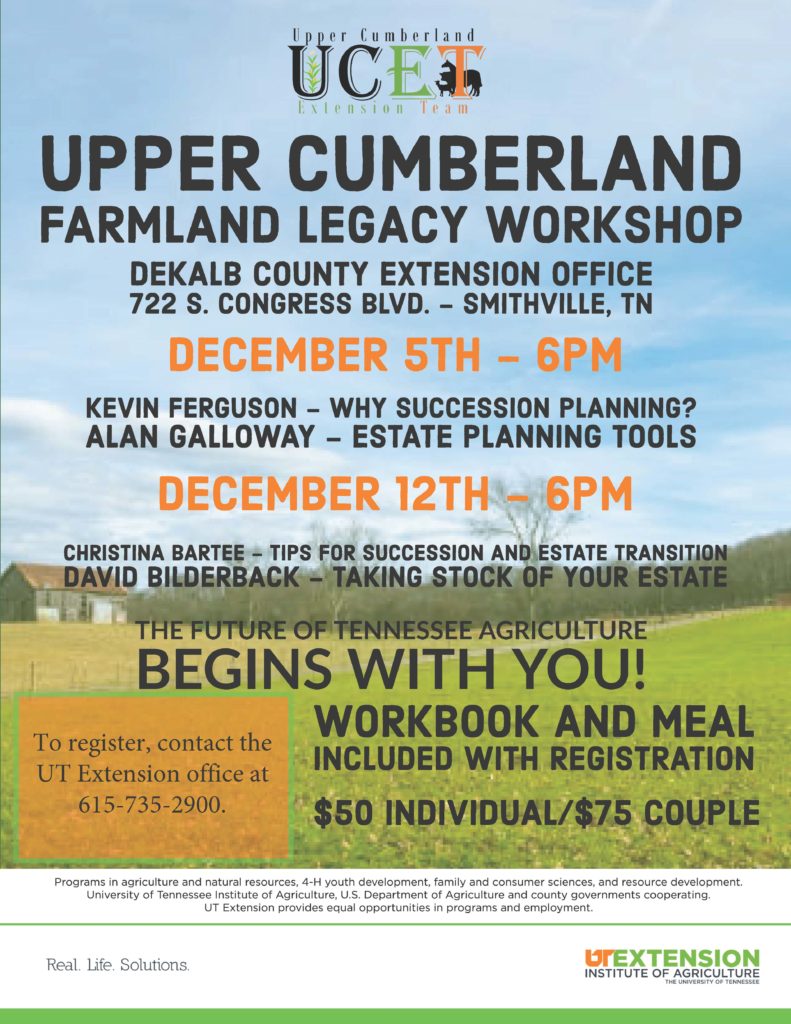

Do you have a clear succession plan in place? Have you had ‘the talk’ with your heirs to express your wishes and determine theirs? Do you have an estate plan in place, including a will and other legal documents, designed to minimize estate taxes and arguments upon your death? If you haven’t prepared for the eventual transition of your estate, what is holding you back? To help answer these and other questions, the Upper Cumberland Extension Team will be conducting a Farmland Legacy Workshop in December of 2022.

Farmland Legacy workshops are designed primarily to assist farm families with estate planning, to provide for an orderly succession of farm properties, and maintain family farms for future generations. However, the classes are open to anyone interested in estate planning. Qualified experts including estate planning attorneys, Extension Specialists, and other professionals will conduct the workshop.

The two-night workshop will be held December 5 & 12 from 6:00 p.m. – 8:00 p.m. at the Dekalb County Extension office at 722 South Congress Blvd in Smithville, TN. The cost for the program is $50 per person or $75 per couple and meals will be provided both nights. Participants will also receive a workbook and publications to help them get started in estate planning.

Night #1 – December 5, 2022 at 6:00 p.m.

- Kevin Ferguson – Why Succession Planning?

- Alan Galloway – Estate Planning Tools

Night #2 – December 12, 2022 at 6:00 p.m.

- Christina Bartee – Tips for Succession and Estate Transition

- David Bilderback – Taking Stock of Your Estate

To sign up, please call the UT Extension office at 615-735-2900 by December 1.